Know What the Customer Really Values

A sales rep had a long-term relationship with the head of an in‑house printing group, and he expected to get the business when the company decided to outsource its printing services. The rep was shocked to find out the deal went to a competitor. His contact told him the other company offered a “better value.” The sales rep thought he knew the customer, but now he wondered, “What did the other guy know that I didn’t?”

The sales rep in this example was sure he knew what the printing manager was looking for — she frequently told him how much she prized his company’s quality, reliability, and service. What he didn’t know was that the buying committee included several finance people and a key user who were very concerned about price, rather than all the extra service the rep emphasized in his proposal. In short, he failed to win the deal because he didn’t understand what the customer values.

Salespeople often believe they know what the customer wants and needs, based on their own company’s value proposition and one or two discovery conversations with trusted contacts. Or they may be responding to an RFP that spells out the official requirements — information that is shared with all bidders. In fact, this information only tells part of the story and will not protect against competition. In the case above, the salesperson knew that her contact valued quality and service. However, a competitor discovered that the CFO was concerned with avoiding large capital expenditures. The competitor learned this from either a broader mix of stakeholders or from one contact who was well-informed about the decision makers’ real view of value. In this case the competitor outmaneuvered the salesperson. How can salespeople avoid the pitfalls of gathering too little or misleading information?

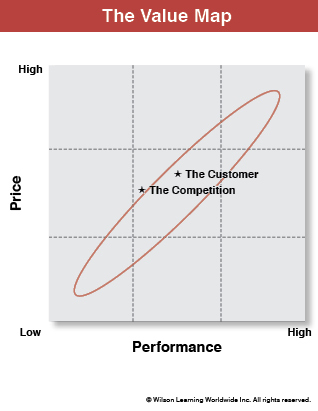

The Value Map is one simple tool salespeople can use to determine the customer’s true view of value. Using the Value Map, it is possible to carry out a detailed analysis of the customer’s value position and where the salesperson stands relative to the customer and the competition.

There are two components to value: price and performance. Some buyers want the highest performance and are willing to pay for it. Others will accept lower levels of performance in order to get a lower price. Between these two extremes is the fair value line, and every customer is somewhere on this line.

There are two components to value: price and performance. Some buyers want the highest performance and are willing to pay for it. Others will accept lower levels of performance in order to get a lower price. Between these two extremes is the fair value line, and every customer is somewhere on this line.

The important thing is how the buyer defines price and performance. For some, performance means the latest technology, while for others it is a high level of service. Similarly, customers define price differently. Some will be more sensitive to initial price and cash flow issues. Others will focus on the long-term costs of ownership and the total price over time.

With these different views of value, salespeople can be at a competitive disadvantage for two reasons: they don’t understand how the customer defines price and performance, and they don’t know where the customer is on the fair value line.

To create a competitive value strategy, ask yourself these questions:

- How does the customer define performance?

As information is gathered about the customer, it is essential to know the definition of performance from the customer’s perspective, not your own. Don’t think because your company is known for the latest technology that the customer values that highly. What does the customer think is most important to solving their problem? Is it after-purchase service? Ease of use? Reliability?

- How does the customer define price?

Like performance, customers will define price differently. Some customers need to keep the outlay of capital to a minimum, so initial lower cost and long-term payments represent a better price. For others, the total cost of ownership is more important, and they can accept a large initial payment if that will lower the total cost of the product over its lifetime.

- Where are you, the customer, and the competitor on the Value Map?

Once you understand the customer’s idea of value (price and performance) you can place the customer on the Map, and then you and your competitors. Where are you relative to the customer and the competitor? Clearly, if you are closer to the customer on the Value Map than any of the competitors, then you have an advantage. If you are aligned with the customer on price but to the right on performance, then you are offering superior performance at the price the customer wants.

If, however, you are not aligned with the customer or are not the closest to the customer on the Value Map, you will need to consider a strategy to compete on the customer’s view of value. You will need to have a better aligned offering than the competition.

- What is your strategy to compete?

If your position is not where the customer is, your overall strategy should be designed to bring your offering closer to the customer’s position than any of your competitors. For example, suppose you are at the higher end of the fair value line and your customer is on the lower end. You might consider unbundling your solution, offering an attractive financing deal, or providing an option for less expensive parts or equipment. The adapted offering would put you in a position of providing value that is in line with the customer’s position on the Value Map, making it possible to outsell the competition.

The key is to focus on aligning with both the customer’s definition of value and their position on the Value Map. If the Value Map is used to identify the customer’s value position and competitors’ positions relative to the customer and the salesperson, an effective competitive strategy can be crafted that will offer customers exactly what they want — and put the competition out of the running.