Did you hear the one about the two guys out camping in the woods when a big grizzly bear strolls into their campsite? As the one guy starts running, the other pauses to put on his sneakers.

“What are you doing?!” the first guy yells out. “You’ll never outrun the bear!”

“I don’t have to!” his partner replies. “I just have to outrun you!”

If you have been keeping up with my column you may have learned the theory behind my investing approach, which is sort of like the story above. One of the processes I use to manage my clients’ investments is something called relative strength. This measures one investment against another in one picture, and against the entire stock market in another. Relative strength is possibly the single best approach to keep tabs on winners and losers in the stock market.

How do you know if your investment is merely taking a breather, pulling back, or is in the throes of a free fall descent?

Relative strength, along with point and figure charts, can often hold the answer.

When a stock has a chart with positive relative strength they have a tendency to go up faster than the rest of the market — and to go down slower than the rest of the market.

When a stock has a chart with negative relative strength they have a tendency to go up slower than the rest of the market — but go down faster than the rest of the market.

This month I want to illustrate how the application of relative strength may increase the probability of your own success in investing. Making a relative strength calculation is quite simple.

You start with the asset you want to evaluate and decide what you want to evaluate it against. In the investing world the Standard & Poor’s 500 index (or S&P 500) is what most advisors use as a benchmark. In my opinion they’re using the wrong index by today’s standards. A more accurate index is the Standard and Poor’s Equal Weighted Index. (I discussed why I think this index is the better tool to use in my May 2013 article, “Two Beers, One Napkin and a 401(k),” in Agency Sales.)

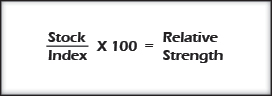

The relative strength formula is as follows:

Let’s look at one example of how using relative strength might possibly help you improve your retirement or investment portfolio.

ABC Corp. has a current stock price of $50 per share. The S&P 500 Equal Weighted Index has a value of 2352. The relative strength reading for ABC Corp. versus the S&P 500 Equal Weighted Index is 2.13. To determine if relative strength is improving or declining you have to constantly run the relative strength calculation daily. If the price of ABC Corp. rises to $57 and the S&P 500 Equal Weighted Index moves to 2400, the relative strength reading is 2.375. While both rose in price, ABC Corp. grew at a much faster pace.

So relative strength calculations use past data but are crucial tools in determines what overall trend of ABC Corp.’s price should be going forward.

If the relative strength number continues to increase, it’s a clear sign that ABC Corp. is on pace to outperform the index. Using relative strength will also show when ABC Corp. is starting to lose its momentum and might need to be sold. Seeing the relative strength of ABC Corp. drop is an indicator that it is losing strength versus the overall market. If the relative strength number remains the same then both ABC Corp. and the S&P 500 Equal Weighted Index are moving in tandem and there is no advantage to investing in the index or investing in the individual stock.

Relative strength can be used not only to compare an individual stock versus an index, but can also be used to compare an index to an index, an asset class to an asset class, even a mutual fund to a mutual fund.

One of the fastest growing areas of my practice is helping clients get their 401(k) accounts back on track. The use of relative strength is almost endless. You can use it to compare almost anything you want to. It can even be applied to your everyday life.

So maybe you’d like to take a few extra seconds to pause and lace those sneakers up.