The spring daffodils poking their heads up is a clear sign that the college basketball season has wrapped up and the celebrated NCAA Division I Men’s Basketball Tournament — often nicknamed “March Madness”— has seen its last highlight. In anticipation of that month-long event people all over the country scrambled to fill out their brackets and cheered on their favorite teams.

For the uninitiated, the tournament begins with 68 teams and operates in a knockout format, concluding with just one team left standing after three emotion-filled weeks and 67 exciting games.

It’s also the foundation for recreational office pools and bracket tournaments shared among friends and family. As these fun-loving participants fret over their brackets and debate which of their favorite teams has the talent to make it to the finals, included in everyone’s selection process is each team’s designated “seed” which shows where the team is ranked in their region and overall.

The NCAA began seeding teams in 1979 as a way to ensure that the strongest teams didn’t meet each other early in the tournament. The seeding also gives the average sports fan a starting point from which to make their picks as well.

Let’s not kid ourselves, no matter how diehard of a basketball fan you are, you are also an independent manufacturers’ representative, and you don’t have time to follow 68 teams throughout the season. Further, you have no idea who those 68 teams are at the beginning of the season.

The Process

The process of selecting the teams you believe will advance in your bracket is biased. For instance, being born and raised in Northern Ohio, I give preference to those teams in the Big Ten conference merely because those are the teams with whom I am most familiar.

I can say with confidence that this is no way to make prudent investment decisions. I am not the most astute college basketball fan in the world, but I would consider myself to be somewhat knowledgeable in that arena. While the Big Ten is arguably the best overall conference in college basketball, having a “hometown” bias does not always improve one’s odds during “March Madness,” nor does it necessarily help one’s investment returns in the financial markets. The most sound investment decisions that I have ever made have been based completely on objective (as opposed to subjective) information.

History of Games Won

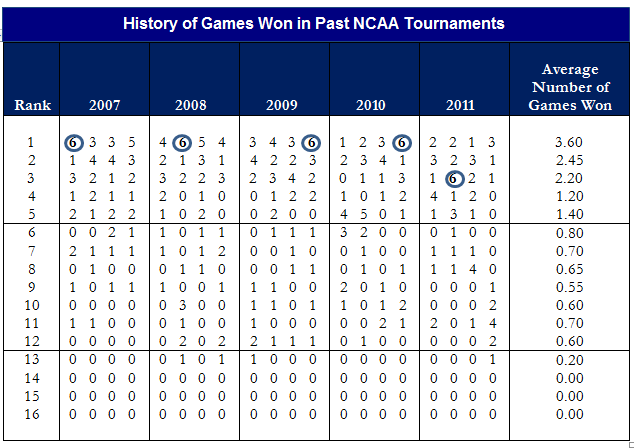

With this in mind I’ll share a few observations from analyzing the NCAA brackets for the past five years to ascertain how often those highly ranked teams win. To win the tournament, you must win six games. The chart on the next page demonstrates how many games the top-ranked teams have won over the past five years as compared to all of the lesser-ranked teams.

Bear in mind that in order to win the tournament you must win six games. Notice 3.60 is the average number of games won by a number-one ranked team, which is a stark contrast to any team ranked six or lower. The average number of games won by a team ranked six or lower is less than one. In fact, during the last five years, those teams ranked 13th, 14th, 15th and 16th have collectively won just four games.

On the other hand, those teams ranked in the top five spots have won a collective 217 games! Clearly it would be fitting for you to pick those teams ranked higher in the standings to advance to the next round than to pick those ranked in a low position.

Picking Investments

Selecting teams to win the NCAA tournament is the same as picking investments for your portfolio. The intent is to identify the investments with the greatest likelihood of outperforming the overall market.

The most objective tool I have found to do this is relative strength. Incorporating relative strength into your portfolio analysis will force you to invest in the right areas of the market, (like the Energy sector from 2000 to the middle of 2008). But possibly, and more important, relative strength will force you to get out of investments that aren’t working, (like the Equities market in early 2008).

So don’t scoff at the person who fills out their brackets based entirely on seeds. They’re playing the percentages, whether or not they realize it. This goes a long way to explaining why the winner of the office pool is usually the person who knows little or nothing about basketball. (Chances are, they’re also the person everyone else turns to for help with the photocopier or retrieving their voice mail messages).

No matter what method you choose to complete your bracket, I hope you enjoyed this year’s tournament. It truly is the Mardi Gras of American sporting events year after year.