A question I’m most often asked at the beginning of each year is, “Where do you see the Dow Jones Industrial Average heading this year?” The New Year always brings wild predictions from “experts” who have allegedly figured out what this market is going to do.

Some people have developed theories that the Dow Jones Industrial Average will close the year above 15,000, while others are positive that the market is doomed to fail, so it would be better to pack up and pull out. And the financial pundits and news media appear to be trying to tell the market what to do as opposed to listening to what the market is telling us.

I understand that all of this can leave you with knots in your stomach, unsure of which way to turn. In situations like this, it’s easy to throw in the towel, dump your entire portfolio and sit with the cash. However the idea that buying nothing, or standing on the sidelines playing it “safe” is completely misguided.

Listening to all the predictions can leave your head spinning. It’s why I don’t make predictions on where the market is going. In truth, I’ve embraced the words of a great American financier, John Pierpont Morgan, who, when asked what he thought the market would do — prompting people to move to the edge of their chairs in anticipation — simply responded, “It Will Fluctuate.”

The cold hard truth is I have no idea what the market will do in 2013. Santa did not bring me a Magic Eight Ball for Christmas, much less a crystal ball. But the best gift I’ve been given is a set of indicators that tell me whether supply and demand are in control of the overall market, sectors and individual stocks. Using these instruments one can navigate just about any type of market. And while I’m hard-pressed to make market predictions, these indicators allow me to piece together a helpful list of “themes” for the coming year.

Develop a Discipline

In the past 27 years I’ve learned to follow the “Point and Figure” methodology, which is entrenched in the irrefutable laws of supply and demand. While the idea of charting price changes each day may seem simplistic, it reminds me of a quote from George Washington, who opined: “Discipline is the soul of an army. It makes small numbers formidable; procures success to the weak, and esteem to all.”

With all of the financial data available at our fingertips, the daily high and low is a “small number.” The same is true of a relative strength calculation. But the self-discipline to apply these principles makes them very formidable. For instance, those small numbers let us know that the U.S. housing industry was beginning its recovery back in November, 2011. The numbers let us know the healthcare sector demand was coming back last July. More significantly they signaled to us to divest our portfolios of all stocks in November 2007 and not reinvest in U.S. equities until September 2009. It always was and always will be the power to understand — and the ability to act — that turns information into profits.

You Must Remain Agile

Since 2001 I have been advocating that we are in a “Structural Fair Market” in which there could be several periods where the market could run up 20 percent and several periods when the market could drop 20 percent. When the dust settles, you’re usually right back where you started. And that is essentially what has been happening since 1999. If you’ve been a buy-and-hold investor, you’ve made no progress toward increasing your portfolio’s value and yet you are nine years closer to the day when you will need the money.

For the investor who is prepared to move with the tide, you’ll be able to take advantage of big up-moves in the market and avoid the pitfalls that really put an account behind the eight ball. During the last structural fair market of 1965-1982 there were periods with terrific rallies followed by gut wrenching sell-offs.

Leadership Will Change

Just as produce in the supermarket rotates in and out of season, so do trends in the markets. There is a reason you feast on corn on the cob and fresh watermelon slices at your July 4th picnic and have pumpkin pie for Thanksgiving. In your portfolios you must be prepared to rotate as well.

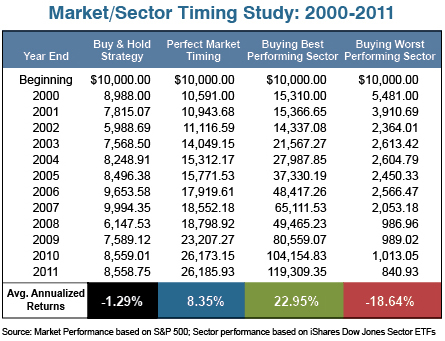

One example of the influence that sector rotation can have on your portfolio is a hypothetical study. In this study four different equity strategies were used: Buy and Hold, Perfect Market Timing (each year), Buying the Best Performing Sector (each year), and Buying the Worst Performing Sector (each year).

The first investor is Mrs. Buy and Hold. She just buys the Standard & Poor’s 500 and keeps her investment in a safe deposit box where it never changes. Our second investor, Mr. Perfect Market Timer, is only invested in the S&P 500 when it has a positive return. Our last two investors are sector investors, one of which is clairvoyant enough to know each and every year what the best performing sector is going to be for the year, and subsequently places 100% of their portfolio in that sector. The fourth investor is an unfortunate person as he manages to find the worst performing sector each year.

As you might imagine, each of the investors had markedly different results from their initial investment of $10,000 back in 2000. Mrs. Buy and Hold shows a portfolio value of $8,558.78 through 2011. Mr. Perfect Market Timer has a portfolio value of $26,185.93. Ms. Best Sector Timer has seen her portfolio grow to $119,309.38! All while Mr. Worst Performing Sector Timer’s portfolio plummeted to $840.93.

To put it another way, the average annualized return for the Buy & Hold strategy since 2000 has been 1.29 percent. Mr. Perfect Market Timing is 8.38 percent. Ms. Best Sector Timer is an amazing 22.98 percent. And on the other side of the coin, the average annualized return for Mr. Worst Performing Sector Timer’s portfolio is 18.64 percent.

Please keep in mind I am not recommending that you put all your money in one sector. I’m just attempting to show you the gap between the best and worst performing sectors each year and the opportunities available if you utilize the tools available to rotate between sectors.

Look Forward Not Backward

We all make mistakes. I hate to make a mistake as much as anybody, but no one is perfect. However, we all become better people if we learn from those mistakes. Don’t worry about 2012 if your investment portfolio severely underperformed. If you made some mistakes with your account, look at it as a learning experience. Gain some knowledge from it. You might have invested in Facebook on its first day of trading only to see it decline by 50% in the next 5 months. Learn from that mistake. If 2012 was a good year for your portfolio, think about what you did different from the previous year to make it better.

Think of what you actively did to help make it a good year and try to do more of it. Try to act, don’t react. Don’t let things happen to you; you should make them happen yourself. Be proactive, not reactive. Think ahead. CNBC and Bloomberg Business will tell you what’s happened. You need to think a few moves ahead.

It truly does not matter what the market holds for us in 2013. As Yogi Berra, one of the all time great catchers in baseball, said, “You can observe a lot just by watchin.”

The market is the same way. There are so many sophisticated computers out there that can make hash out of any equation Einstein could think up, but it’s the investor who simply pays attention to a few basic indicators, keeps it simple, and adheres to a logical, organized plan that does the best.

Two Key Rules of Market Engagement

Rule #1: Don’t Lose

- Investing is truly not a business of hitting grand slams. It’s a business of avoiding substantial reductions in capital.

- This is contrary to how most of us are stimulated by advisors and firms. Investment firms are always coming up with their lists of investments that will double or triple in value over a relatively short period of time.

- All you need to do is align your portfolio to what Albert Einstein referred to as one of the mathematical mysteries of the universe. And we all know that Albert Einstein was a pretty fair mathematician.

- The mystery that Albert Einstein was referring to was the power of compounding. And the only thing that destroys the power of compounding is the loss of principal.

- It would serve you well to have in place a discipline to recognize and trigger action at “unacceptable levels” of capital loss.

Rule #2: Take Losses

- You may be thinking, “Wait a minute Roger, first you say don’t lose, now you are saying take losses.”

- Why?

- I will be wrong.

- We live in a world of probabilities and possibilities.

- That is the way it is.

- The unsuccessful advisors assume they will never be wrong.

- Successful advisors understand that they will be wrong.

- We have as part of our investment strategy a discipline that keeps us from pursuing disasters over long periods of time.

- That keeps us from having an emotional attachment to any investment. It allows us to say what is, is. I was wrong. Here is what we should do about it.

- It is counter-intuitive.