Savvy sales managers already know the most effective ways to build a list of reps to interview for an open sales territory — but now there is another way to search for potential reps based on lessons learned from Amazon.com.

Five traditional techniques to search for potential reps include:

- Search MANA members from the manaonline.org database available to all manufacturer members.

- Talk to your existing customers in the territory — who would they recommend?

- Ask your reps in other territories — who do they know in the vacant territory?

- Put “Rep Wanted” signs in your trade show booths.

- Build a rep company from scratch by offering a vacant territory to one of your own current employees who is eager to start their own business.

The sixth tool that sales managers can employ is data mining, with inspiration supplied by Amazon.com. To see how data mining works, search Amazon.com for Robert Calvin’s Sales Management Demystified. Amazon finds the book you asked for and also displays on the same page a note to tell you that customers who bought Sales Management Demystified also bought Building a Winning Sales Force: Powerful Strategies for Driving High Performance by Andris Zoltners.

From its own sales data, Amazon knows that Calvin’s book and Zoltner’s book often go together. And with data readily available on the web, you can use the same kind of “these things go together” calculations to find great rep companies to add to your list of candidates next time you are interviewing for reps.

Let’s look at a real-world example of how this system works. I started with the actual line cards of 23 manufacturers’ rep companies which have a large principal in common. For the purpose of this example we will call this large common principal Smith Manufacturing. Imagine that you are the sales manager of Smith Manufacturing and you have a vacant territory to fill. Start by capturing the line cards of all of your current reps from their websites.

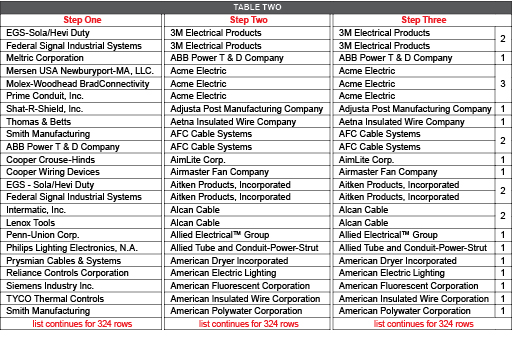

Now let’s look at two of those line cards side by side in Table One. Rep Company Alpha represents nine principals, Smith and eight others. Rep Company Beta represents 14 companies, Smith and 13 others. In addition to having Smith in common on their line cards, these two Smith reps also have EGS-Sola/Hevi Duty and Federal Signal Industrial Systems in common.

Now let’s look at two of those line cards side by side in Table One. Rep Company Alpha represents nine principals, Smith and eight others. Rep Company Beta represents 14 companies, Smith and 13 others. In addition to having Smith in common on their line cards, these two Smith reps also have EGS-Sola/Hevi Duty and Federal Signal Industrial Systems in common.

If we studied the data from just these two line cards the way Amazon.com studies its data, we might draw the conclusion that “lines that go together” with Smith would include EGS-Sola/Hevi Duty and Federal Signal Industrial Systems. But the data from just two line cards might be a coincidence, so we need to add more raw data before we start data mining.

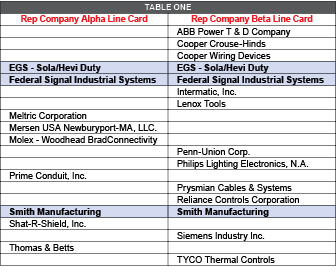

With the line cards of 23 Smith reps in hand, we have enough raw data available to make a more compelling correlation between Acme and other brands on those line cards. And the technique illustrated in Table Two is extremely simple.

Step One: List all the lines from all the line cards in one column of an Excel spreadsheet.

Step Two: Sort it alphabetically.

Step Three: Count how many times each principal appears. In the table below, for example, we see that 3M appears twice, and Acme appears three times.

The format of this magazine does not allow us to show all 324 rows, but scrolling through the entire spreadsheet reveals that Federal Signal Industrial Systems appears 10 times, Mersen USA Newburyport-MA, LLC, appears nine times, and EGS-Sola/Hevi Duty appears eight times.

So if you were Smith’s sales manager and you had a vacant territory, you would want to be sure to include that territory’s rep for Federal Signal Industrial Systems, Mersen USA Newburyport-MA, and EGS-Sola/Hevi Duty in your review of available reps.

Does this kind of review replace one of the traditional five ways sales managers identify potential reps in a sales territory? Absolutely not! After all, there is no way to know from the data available if correlation between Smith and Merson grew organically because the fit is excellent or if the only reason that so many reps have both Smith and Merson on their line cards is that Merson’s sales manager started his or her rep search from a Smith rep list decades ago and only eight of the reps hired at that time somehow held onto both lines. Data mining is simply the sixth tool sales manager can use to assemble a list of candidates to interview.

And this system works just as well for sales managers who don’t have an existing rep network from which to mine this data. Just mine the data available for the company with which you want to compete. For example, suppose you are a company that wants to compete with Smith but are just starting with reps. Smith’s list of reps and their line cards are easily located on the Internet — complete the same exercise that you would have completed if you were Smith’s sales manager and you too will conclude that your list of potential candidates also should include reps for Federal Signal Industrial Systems, Mersen USA Newburyport-MA, and EGS-Sola/Hevi Duty.

Data mining is a cheap, simple sixth method to add to the traditional five ways sales managers identify potential reps. And when the difference between a good rep and a great rep could mean a seven-figure difference in your company’s sales, shouldn’t you be following the lead of Amazon.com and making data mining a key element of your business practices?