Predicting the future is at best an uncertain art. We have to look no further than meteorologists, economic forecasters or football prognosticators to appreciate the truth of that statement.

There’s another statement, however, that bears some attention as reps consider what might await them in the years to come: The best predictor of future behavior is that which has happened in the past.

It would appear that reps — at least those who have been interviewed for this article — take those words to heart as they look down the road a bit.

Don Elfstrom, CPMR, CSP, Kacey Enterprises Inc., Glen Ellyn, Illinois, refers to an article entitled “The Rep of the Future” that appeared in the November 2010 issue of Agency Sales magazine when he considers what the future might have in store for him and other reps. Using that article and the survey it reported on, he comments on several of the specific points expanded upon in the Rep of the Future survey.

According to Elfstrom, PTRA immediate past president, “I would categorize the margin pressure expected in the future as just normal. Prices are going up in all component categories, and buyers and distributors are trying to pass it on somehow — either on to the customer, or back up to the manufacturer. My experience has been to not get hung up on price, hold the ground on that, then in turn be excellent (not perfect, just shoot for excellence) in customer service, and inventory availability. Inventory level is the real problem. Every component made from metals has on-time delivery problems. In this environment today, the rep with stock is the winner regardless of price; therefore, margins are protected.

“A transition worth highlighting that is related to this subject — traditionally distributor partners have made 25–40 percent margin; whereas in our industry a rep will get 5–10 percent. That model was built when the rep and the distributor salesperson developed business together. Once the sale is closed the distributor branch would service the customer and maintain inventory. That has drastically changed in the last 10–15 years. now, the rep performs the development work on behalf of the distributor. Then the distributor does some customer service work, and oftentimes does not inventory the product, yet the 5 percent to rep, and 30 percent to distributor ratio still applies. Many of us more progressive rep agency owners are always looking for an opportunity as the result of this scenario. ‘Pay for performance’ really applies here. What if in the future the rep and distributor both were to split evenly a 40 percent margin, and the distributor would not have to hold inventory?”

Some of the other survey areas Elfstrom commented on include the following:

- Manufacturer cost reductions —“As far as sales cost goes, I find cost reductions continuing to work in the rep industry favor. From an accounting standpoint, a direct employee shows up as a harder cost than an outsourced solution.”

- Growing importance of manufacturer-rep contracts — “Ten years ago, the 30–day cancellation clause was the norm. Now, most new contracts offer a 60–day agreement. This is progress, and I would give credit to our industry when it comes to educating the manufacturing business as to the impact of rep firms losing an important revenue stream so suddenly. Also, this is a leverage issue. This should work towards a 6–12 month clause as the rep agency network becomes more crucial or important to the manufacturer. This is the only sticky issue with contracts. Really, as long as contracts have 30–, 60–, or 90–day clauses, the rep has no protection (a one-way deal), and the contract is just a memo of understanding.”

- Demand creation vs. demand fulfillment — “As an example of how we’re reacting in this area, we are adding Permission Based Marketing (e-mail advertising) and other marketing functions as part of our services. We have to. It is my belief that most manufacturers do not do this well. They make stuff — the full-service rep serves customers.”

- Impact of technology — “We can close a lot of new business by using the technological tools in place of going out and making sales calls. I always say that the close is in the follow-up. If we become efficient with technology, use it to be excellent at follow-up, and, in turn, increase the close rate, we will win.”

- Geography and specialization — “We have considered having ‘divisions’ within our company, and I know a significant rep company that has already implemented this. It would be worthwhile and necessary if there is more than one significant revenue source that is not synergistic with another. We also have considered hiring specialists who would act as an extension of the principal to the rest of our sales force. We are pursuing a product line currently that has significant business base in the territory and our people are not particularly versed on the technology. Our offer to them is that we will hire a specialist to support our people in the field.”

- Manufacturer and rep consolidation — “The trend here is positive. In our area consolidation is happening and agencies, in turn, are becoming larger. That enables for more services to the manufacturer. As a result, the agency is perceived as more valuable and necessary and hence has more leverage for a better contract with real protection. I hear more manufacturers (especially the larger ones) saying they prefer larger, more-established agencies.”

- Globalization — “This has been a part of our long-term thinking and there have been some ‘deals’ or opportunities for us to conduct business abroad. However, the most immediate opportunity for reps is still on the domestic front. Yet, as an agency owner, I have my antennae out looking for what the global business network can bring in terms of opportunities. I see this being a factor in the next 10–20 years, yet it is so much in its infancy that I don’t see how yet.”

Getting Out of a Mess

Elfstrom wasn’t the only rep with opinions concerning the future. Former MANA Board member Al Brosseau, CPMR, shared his thoughts about the rep facing the future.

As he looks at the challenging economy reps and their industry partners have been working in for a few years now, he notes, “It took us years to get ourselves into this mess. It will take us years to get ourselves out. The current conditions are here for a while.”

Some of the future steps reps have to consider in order to get out of this “mess,” according to Brosseau, who writes a monthly newsletter entitled The Thinking Salesman Letter, include these:

- “Reps need to get out of this ‘commission only’ mindset, become marketers, offer new and chargeable services and exploit distribution niches where the margins are higher. Usually we’re left with the technical products, but the old ‘30-day cancellation contract’ and strict commissions will not allow us to thrive. We need to develop new models of remuneration such as the LOP/LOP agreement.”

- “Reps should concentrate on technical products that can’t be sold via the Internet. They must work with manufacturers who are willing to make long-term commitments.”

- “Agencies must merge to create super agencies and super territories. It’s the only way to compete against the conglomerates that ‘offer’ a wide range of products and use one against the other at the distribution level.”

Multiple Challenges

There’s a certain consistency in the comments of Elfstrom and Brosseau as they consider the challenges the rep of the future faces and the changes reps will have to make in order to succeed. That level of consistency doesn’t change as other reps weigh in on subjects such as the impact of technology, commission pressure and manufacturers’ proclivity to offload marketing duties to reps.

Kevin Venezia, Damin Sales, Edison, New Jersey, readily acknowledges how technology has impacted and will continue to impact the rep in the future. Putting that impact aside for a moment, he focuses on how the relationships between rep and principal will evolve in the future. “I certainly see that manufacturers will be looking to their reps to perform more of their marketing work. It’s simply a case of the manufacturer looking to decrease his costs and have someone else perform that function. When that happens, the impact is generally felt by the rep. Hence, when the manufacturer downsizes his staff (i.e., marketing department), those duties fall to the rep.”

Returning to the subject of technology, he does see a bit of light at the end of the tunnel. “Thanks to technology I’ve seen two of my principals recently take back some of their marketing tasks that they were previously off-loading to us. They’re able to do that even though they may not fully staff a marketing department. Thanks to advances in technology they can perform some work with a short staff.”

Venezia adds that as the rep and manufacturer continue to work together in the future, it’s important for the rep to continue to communicate/educate the manufacturer as to the complete role of the rep. “I’d maintain that the manufacturer doesn’t always understand what we and the distributor do — specifically in the electrical channel. It remains up to the rep to help explain the situation.”

Despite the challenges that the future offers, Venezia maintains he’s still very happy being a rep and he’d certainly recommend it as a profession. “I think the future is one that will see the manufacturer looking to work with fixed costs and that’s where the rep comes in. The manufacturer knows exactly what it’s going to cost him to work with an outsourced sales staff. At the same time, one thing I would like manufacturers to consider in the future is to pay us on increased margin rather than increased sales.”

Delivering a similar message is Barry Oliver, Electrolink Sales, Albuquerque, New Mexico, who notes that “In the past manufacturers performed much of the work that is now required of us. We now enter orders, follow backorders and check stock. We now go into their systems and continue to upgrade our operations in order to perform all that is required of us. We do this at the same time that our commissions are not being increased.”

As he describes a situation that is hardly a surprise to other reps, Oliver sees some hope for the future. “I’ve served on a number of rep councils and had meetings with all of their CEOs, CFOs and COOs. During the course of those meetings I let them know how efficient we can be for them in a number of markets. At the same time I let them know that if they keep pushing down on us with no increase in commission, we may reach a point where we’re not a viable option. The good thing is we’ve had excellent conversations and they get the message.

“We reps have control over our futures. Anyone who says we can’t impact our future destinies is sadly mistaken. We can institute change, and it’s our job to educate and inform the manufacturer as to what we can do for them.”

Importance of Relationships

As he peers into the future, Mike Cuddy, Renaissance Electrical Marketing, Pittsburgh, Pennsylvania, spends some time commenting on the continued importance of relationships and the pressure manufacturers continue to exert on commissions.

“On the commodity side of the business,” he says, “there will always be a handful of survivors (reps) as long as manufacturers see the need to have someone in place who has those relationships with purchasing managers. When it comes to the rest of the products — the more technical or ‘Smart’ products — you’re going to need smart salespeople who understand the Smart products. At the same time, you have engineers and end users who make purchasing decisions who are going through the same sales productivity process that we all are. There are fewer of them and they’re going to need smart reps to fill the role as their resource providers. What that means is that reps will be in demand. It’s as simple as this: the purchasing decision-maker says, ‘I like you (the rep) because you take the time to come in, sit down and take notes about what our needs are. You don’t waste my time by asking me to go out to dinner or for a beer after work.’ Customers are going to be looking for solution providers and that’s what we are.”

Commission Pressure

While the rep is filling that role as solution provider, Cuddy acknowledges that there probably won’t be much — if any — increase in the rep’s commission. “I don’t foresee any increase in commission rates. And that’s a major concern for reps — including me. Manufacturers want us to provide the care and attention to the customer that they think a factory salesman provides, at the same time they don’t have to carry the loaded expense of a factory salesman. They (manufacturers) want you to work all day and report all night. The rep is being asked to work two shifts and if you are an owner of the rep agency, then you’re asked to work three shifts — you manage relationships with customers, you’re held accountable to populate all their reports, answer sales managers’ requests and questions at night. Then after all that’s done, with whatever time is left, we plan for the future of our agencies.”

When he’s asked why anyone would want to be a rep in the future given all the concerns that reps have to face, Cuddy pauses for a moment and explains, “You know, I just got back from a meeting with my accountant and I asked him the very same question. Here’s the situation: you’ve chosen this profession, you do it well and are financially successful. Then you see the challenges we face and so much of our money going to the government. But here’s why we stay:

- A — There are certainly much worse ways of making a living.

- B — Being a rep provides us with a small slice of autonomy.

- C — And, while manufacturers may not want to hear this, the rep of the future is going to be much more important to his manufacturers than the manufacturers are going to be for him.

“The rewards are there now and for those of us who adapt to change, plan and make the right decisions, they’ll be there for us in the future.”

Rep Sees Future Change in the Process

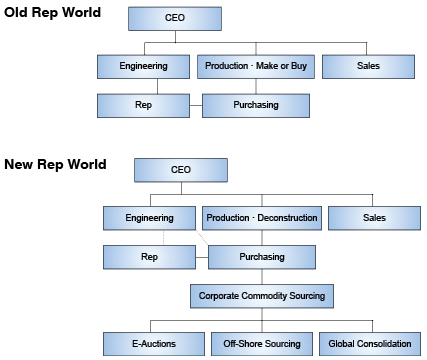

When he’s asked to comment on the rep of the future, Walt Jobst, Jobst Inc., Prior Lake, Minnesota, immediately refers to a chart he put together that shows how the rep selling process used to be and what reps in some industries can expect it to be in the future.

According to Jobst, a look at the accompanying chart shows that the rep has historically enjoyed a direct working relationship with engineering and purchasing department decision makers. What’s changed and what will continue to change, he maintains, is that what was once a direct line between rep and engineering and rep and purchasing has been replaced by an interrupted line that severely hinders the buying-selling process.

“In what I’d refer to as the ‘new’ model,” he maintains, “Engineering and even purchasing have lost touch with sourcing decisions. This has occurred for a variety of reasons, not the least of which is that a Corporate Commodity Sourcing entity exerts its influence, works to protect its territory and discourages communications with outside suppliers.

“In what I’d refer to as the ‘new’ model,” he maintains, “Engineering and even purchasing have lost touch with sourcing decisions. This has occurred for a variety of reasons, not the least of which is that a Corporate Commodity Sourcing entity exerts its influence, works to protect its territory and discourages communications with outside suppliers.

“What used to occur was that reps were successful when they had valuable services and expertise to offer and when they could communicate these services to qualified buyers and engineers who could take advantage of these services to the benefit of their employer.

“Since reps have traditionally not charged up front for many of their services, they would benefit when buyers placed business with the manufacturers/products they represent. What has happened and will continue to happen in the future is that in many large corporations, neither the engineers nor the buyers have influence to select sources. This function has fallen to Corporate Commodity Sourcing. A conscientious effort has been made to insulate the decision makers from outside influences (i.e., reps). Making life that much more difficult for reps is that as a result of this activity, recipients of invitations to shotgun e-auctions can find themselves in a situation where if they ask technical questions about incomplete or conflicting specifications, they are treated as annoyances.”

When he’s asked whether this trend has altered his once-positive view of the rep profession, Jobst says, “My feeling is that at one time this was a nice, not to mention lucrative way to make a living. You were dealing with knowledgeable people who made positive contributions to the process. Ten years ago if my children asked me about entering this profession, I’d say ‘Yes.’ Now, however, if my grandchildren ask whether I’d recommend it in five years, I’d answer, ‘Ask me again in 4½ years.’”