MANA representative members shouldn’t spend any time selling. And I hope that none of the salespeople working for MANA’s representative members spend any time selling either.

Are MANA representative members in front of prospects and customers as zealous promoters of their principals’ products every business day? Absolutely. Do they put in even longer hours preparing for those sales calls and fulfilling the action items those sales calls trigger? More than any other sales force I know.

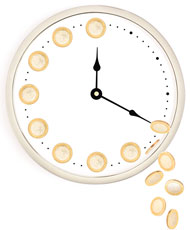

But the most successful ones don’t spend any time selling, they invest time selling.

When I make that distinction, I’m not trying to be cute. I am absolutely deadly serious. What happens if representatives who spend time selling make a sale? Once that sale is made and the commission is received, the representatives are right back where they started, with nothing more to show for their efforts than a single commission payment.

When representatives invest their time selling one of their principal’s lines, they look at a much bigger picture than just the commission on a single sale, things like these:

- How will this sale build our relationship with this principal?

- How will this sale enhance our relationship with this customer?

- How will our strategy for this principal and this customer affect the other principals on our line card and other customers in our territory?

That’s why a top representative’s list of principals isn’t just a line card; it’s a line card portfolio in the truest sense of the word portfolio. And they have the same strategy for their line card portfolio that they have for their stock portfolio: “Buy and Hold.”

It’s true what they say about the stock market. The fastest way to get to a $5 million dollar stock portfolio is to start with $10 million and try to time the market. MANA’s most professional representatives invest time in their line card portfolio that same way a buy and hold investor invests money into a stock portfolio. They carefully choose companies they believe in and make consistent investments in them every month.

Sure, they may occasionally change out a single company in their portfolio, but they don’t go flitting from one bright shiny object to the next each month. They deliberately create a long-term strategy and work that strategy for the long-term. After all, for both the money they invest in financial instruments and the time they invest in their principals and customers, they are investors, not day traders.