Long-time friend of MANA Bob Reiss has graciously allowed Agency Sales magazine to serialize his book Bootstrapping 101: Tips to Build Your Business with Limited Cash and Free Outside Help, available now on Amazon.com. The book looks at surprisingly effective low-cost and no-cost ways to acquire the resources you need to run your company. Whether your company is an existing enterprise or a start up, a manufacturers’ representative company or a manufacturer, this book will introduce you to innovative ways to cut your costs and drive more of your income into bottom line profits.

The bootstrapping strategies in this book can help you overcome your resources and knowledge shortcomings. This can help lead you to initial success. It takes much more for sustainable success.

Entrepreneurs are not born with special genes. Entrepreneurism is a way of thinking, which to me means it is open to anyone. I like to use the definition of entrepreneurism by Professor Howard Stevenson, who largely invented the Entrepreneurship faculty group at Harvard Business School. His definition, with a few amendments of mine, is:

Entrepreneurship is the recognition and pursuit of opportunity without regard to the resources you currently control, with confidence that you can succeed, and the flexibility to change course as necessary, and with the will to rebound from setbacks.

This definition abounds with action words, and successful entrepreneurs are action oriented.

There are four major areas to concentrate on for entrepreneurial success in my opinion. They are attitude, financial, people and knowledge. (Attitude and financial will be covered in this month’s article. People and knowledge will conclude this series of articles in the August issue of Agency Sales.) Let’s examine each.

Attitude

The difference between success and failure in most human endeavors can be mental — the attitude of the individual. Of course, knowledge, skill, and talent (and to some extent) resources are important success components. A shortfall or lack of some of these components can be overcome by one’s attitude or mental makeup, which is totally controlled by the individual. This holds true in sports, business, the arts, politics, etc.

How many times have we seen the underdog player win over the more talented opponent? The difference is attitude.

Here are some attitude attributes to keep in mind in pursuing entrepreneurial success.

1. Have a passion for your business.

Work should be fun. Your passion will help you overcome difficult moments and persuade people to work for you and want to do business with you. Passion can’t be taught.

2. Set the example from day one that you and your company are trustworthy.

People have confidence in trustworthy individuals and want to work for them in a culture of integrity. Ditto for customers.

3. Be flexible except with core values.

It is a given that your plans and strategies must change as time goes on. This flexibility for rapid change is an inherent advantage of small over large business. However, no matter the pressure for immediate sales, do not compromise on core values.

4. Never let up on quality.

Quality is essential for repeat sales.

5. Don’t let fear of failure hold you back.

Failure is an opportunity to learn.

6. Make timely decisions.

It’s okay to use your intuition. Planning and thought are good, but procrastination will make you miss opportunities.

7. The major company asset is you.

Take care of yourself. Maintain your energy level. Your health is more valuable than the most expensive machinery or computer software for the company.

8. Keep your ego under control.

Don’t take newfound profits and spend them on expensive toys to impress others. Build a war chest for unexpected needs or opportunities.

9. New product ideas need not be blockbusters.

This also holds for starting a new company. It’s hard to reinvent the wheel. It’s a little like Scrabble. Add one letter to an existing word and get full credit for the entire word. Build on an existing product or service but do it better, add value, sell to a new market, build a license around it, etc.

10. Maintain balance.

It doesn’t have to be your family or your company. Play or work, etc. This will enhance your mental outlook, which is what we’re talking about.

11. Encourage and accept criticism graciously. Admit your mistakes.

You need to constantly work on convincing your employees that it’s okay, even necessary, to state their honest opinions even it if conflicts with the boss. Just stating it once or putting it in a mission statement won’t cut it for most people.

12. Create an environment where innovation can flourish.

This means hearing out new ideas and suggestions no matter how crazy they sound.

13. Maintain a strong work ethic.

Your employees will follow your lead. It will also help you beat your competition by outworking them — particularly when your product or service is very similar.

14. Rebound quickly from setbacks.

There surely will be plenty of ups and downs as you build the business. Learn from the setbacks and move on. You can’t change the past.

15. Periodically get out of your comfort zone to pursue something important.

Many times you will feel uncomfortable in implementing a needed change in technology, people, mission, competing, etc. For the company and you to grow personally, you sometimes have to step out of your comfort zone.

Financial

One of the most essential skills that you can personally bring to your company is understanding, tracking, and using certain numbers. You don’t need an accountant for this. Simple math and focus are required. You want to get to the point where you think in numbers. I like to call this numeracy. Early stage companies can’t afford full-time comptrollers. Even when you can and have a competent accountant, the person running the company should always be aware of the numbers. Let’s look at these financial points.

1. Always watch the cash.

The number-one reason for companies failing is running out of cash. You need to always know your cash position, when new cash is coming in, and when bills need to be paid. What you need is a cash flow statement. This should be done on a monthly basis, in peak seasons, maybe more often. The statement looks a little different depending on your industry. A service business does not have to take inventory into account like a product business does. The bottom line is you need to be sure you will have cash on hand to pay bills as they come due. Profits don’t necessarily mean cash availability. You can get help in learning how to prepare a cash flow statement for your business from an accountant, your local SCORE or SBDC office, books, or the Internet. Incidentally, a cash flow statement is a must if you want to borrow money. It will indicate when you can pay back the loan.

2. Don’t forget the details. Be diligent in monitoring your numbers.

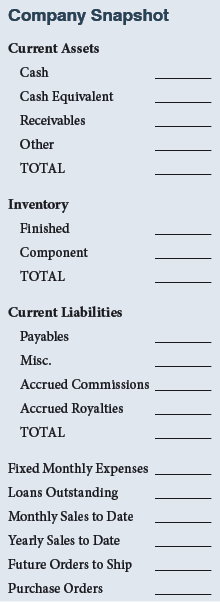

To capture all the key details and numbers, I use what I call a company snapshot. I prefer to see it weekly. You can vary the interval based on your liquidity, seasonality, and special factors of your business. You also can change some of the components you are tracking, based on your business and needs. A service business might not want to track inventory. (See example.)

To capture all the key details and numbers, I use what I call a company snapshot. I prefer to see it weekly. You can vary the interval based on your liquidity, seasonality, and special factors of your business. You also can change some of the components you are tracking, based on your business and needs. A service business might not want to track inventory. (See example.)

This snapshot should be adjusted for your special needs. A service company would take out the inventory component. If you have no licenses or sales reps, then the commission and royalty lines can be omitted.

The receptionist or secretary can learn to fill this out for you, but you have to read and understand it. After a while, it will take five minutes of your time to digest it. Potential problems will jump out at you. For instance, higher than normal receivables without corresponding sales increases could mean your customer collection person is operating on a subpar level or one of your customers is in deep trouble.

3. Profits are good and essential.

Don’t be embarrassed by them. Many in the media and academia frown on business and their greedy profiteers. Pay them no heed. They are in the minority; but most important, without a business making a profit, it is not sustainable. This is particularly true of small business as capital is much less available to them than the large corporations that can sustain losses for long periods. So always keep your eye on the profits, and remember that most of the job creation in the country comes from small business.

4. Always pay your bills on time.

This was discussed at length in the Suppliers chapter. It should be a cardinal rule in the company as the benefits of doing so can be enormous. This is one of the major reasons you are doing cash flow statements: to make sure you can pay on time.

5. Convert fixed costs to variable where feasible.

This is covered in Chapter 3. Doing so can affect your finances in a major way. It reduces your financial risks and lowers your cash needs in slow times.

6. The break-even analysis.

This is a tool that is sometimes overlooked, even though it is easy to determine and gives you valuable information in a number of different contexts. The break-even tells you in dollars or units what amount of sales you need to achieve in order to recoup all your fixed costs or investment. Are you trying to decide whether to proceed with a new product introduction? Are you trying to understand exactly where costs stop and start for your company? Are you trying to decide whether to buy a company? In all of these cases, the break-even analysis should be your tool of choice.

How to do a break-even on a product:

- Determine the cost of the product (let’s say it’s $9).

- Determine the average selling price ($20).

- Subtract a from b, which gives you your profit contribution per unit ($11).

- Determine the total investment required for that product ($80,000).

- Divide c into d. The result is the break-even (in this case 7,273 units).

Once you know the break-even for a given product, you can ask the critical questions. Is it reasonable to attain the break-even sales figure based on (1) the offering, and (2) our knowledge of the current market? In light of the resources that will be required to bring this product to market, how risky is this bet?

A good example of doing a break-even analysis is in Appendix 1, the R&R TV Guide case. The game/toy business is a high-risk product business, particularly with a fad item in a one-product business with a new company. However, with a break-even of 11,709 units and 5 free full-page ads worth $425,000, all risk disappears. One customer that received an ad placed an opening order more than 3 times the break-even.

7. Don’t be afraid to give up equity under the right circumstances.

In some cultures, the business owner is paranoid about giving up equity no matter the circumstance. There are times when selling equity in your enterprise is your only or best option. This is particularly true when the investor brings more to your table than money. It’s the old story: would you rather own 100 percent of a company that yields $100,000 profit a year or 60 percent of a company with $1,000,000 a year in profits?

MANA welcomes your comments on this article. Write to us at [email protected].